E-Invoice Mandate: What Companies Need to Know Now

The ongoing digitalization of the business world is changing the way companies operate and bringing new legal requirements. A key aspect of this development is the introduction of mandatory e-invoicing in Germany and, in some cases, throughout Europe.

It is extremely important to keep a watchful eye on which countries have already introduced mandatory e-invoicing and which will follow suit soon.

E-Invoice Mandate: What Companies Need to Know Now

The ongoing digitalization of the business world is changing the way companies operate and bringing new legal requirements. A key aspect of this development is the introduction of mandatory e-invoicing in Germany and, in some cases, throughout Europe. It is extremely important to keep a watchful eye on which countries have already introduced mandatory e-invoicing and which will follow suit soon.

The primary objective of this initiative is to harmonize the numerous national standards for electronic invoicing and to establish a globally valid system. In this process, the Factur-X file format was defined as the standard for e-invoicing.

To maintain an overview of the requirements that companies must meet, we have summarized key elements of the e-invoicing mandate in this blog post. Our aim is to provide a comprehensive insight into the e-invoicing mandate in Germany, to name the key deadlines and to list the criteria that companies must meet. This serves as targeted preparation for the legal requirements at both national and EU levels.

E-Invoice Requirements: What Conditions Must be Met?

The e-invoice obligation not only entails the introduction of the e-invoice but also other requirements that specify which properties it must have. To meet these requirements, companies must pay attention to various factors:

- Format: The e-invoice must be in a standardized format, e.g. ZUGFeRD or Factur-X, fully documented and machine-readable. The XML format, which Factur-X represents, applies throughout the EU. The format is the standard for electronic invoicing, which implements Directive 2014/55/EU and is therefore based on the European standard EN16931.

- Signature: An electronic signature is mandatory to ensure the authenticity and integrity of the e-invoice. It plays a crucial role in ensuring the invoice remains unaltered during transmission and originates from the authorized party.

- Transmission: The e-invoice must be transmitted to the destination specified by the recipient. Companies must pay close attention to each recipient’s specific transmission requirements to ensure smooth processing.

- Archiving: Companies are obliged to archive e-invoices in an audit-proof manner. This means the stored data must be unalterable and accessible for a certain period.

Timeline of mandatory e-invoicing in the EU

For global companies, compliance with the e-invoicing obligation is a significant challenge. With different implementation timelines and requirements in different countries across the European Union, companies need to take a strategic approach to ensure smooth implementation and global compliance.

In some countries, plans have already been drawn up to introduce e-invoicing in all companies, regardless of size and business sector. However, some transitional arrangements have been established to simplify this process and help companies to manage this transition successfully.

Here are some examples of countries and their planned timelines for e-invoicing implementation:

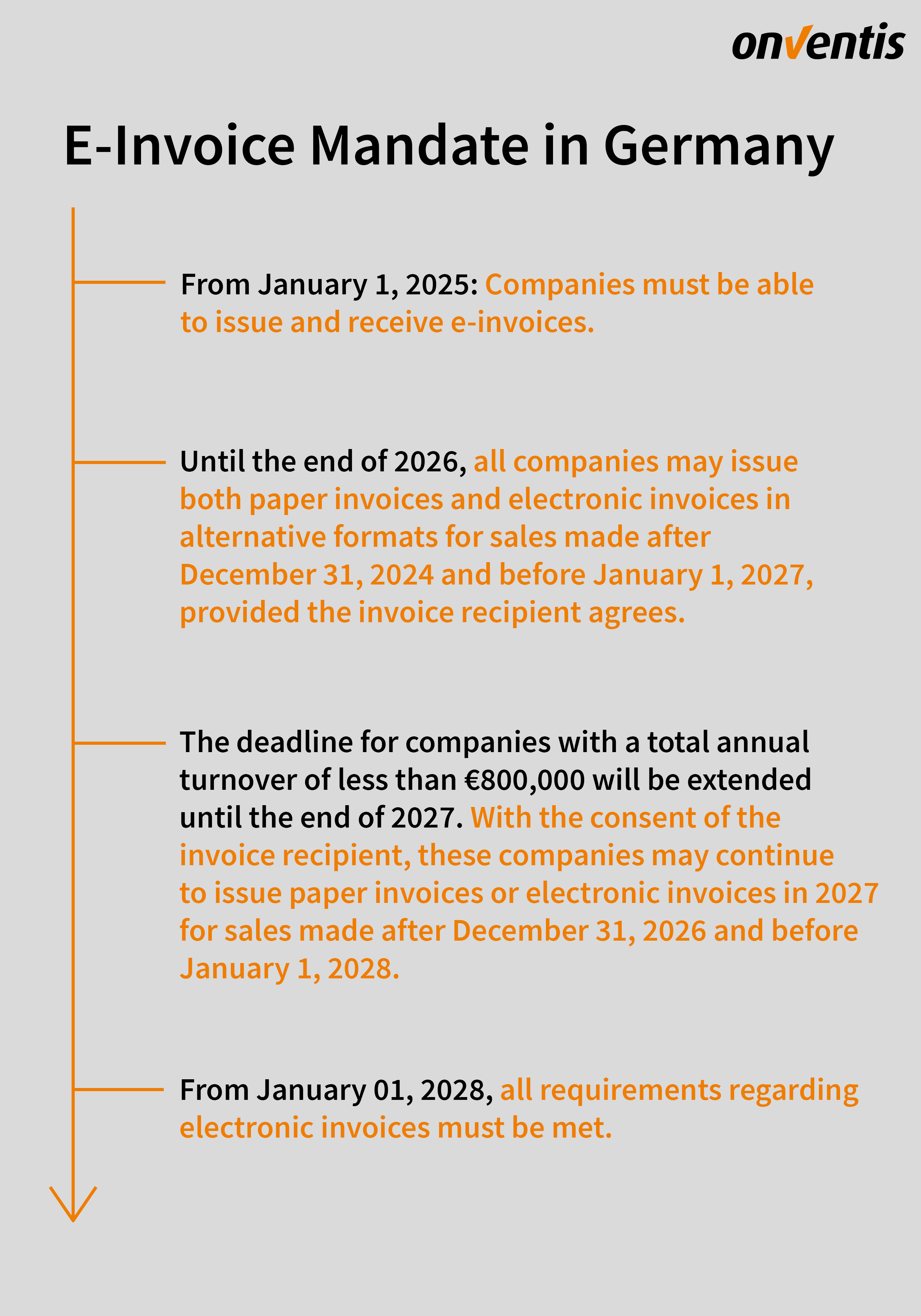

Germany: From January 1, 2025, all companies in Germany must be able to issue and receive e-invoices. Until December 31, 2026, companies can choose between e-invoices and other invoicing forms. This “trial phase” applies to all companies regardless of their size. Companies with a total turnover of up to 800,000 euros in the previous calendar year also have this option for the 2027 calendar year. Starting in 2028, all companies must issue e-invoices for their B2B turnover.

France: From September 1, 2026, large companies with a turnover of more than USD 1.5 billion or more than EUR 2 billion and at least 5,000 employees and medium-sized companies with 250 to 4,999 employees and a turnover of up to EUR 1.5 billion or a balance sheet total of up to EUR 2 billion in France will be obliged to issue electronic invoices and reports. In later phases, these requirements will be extended to companies that do not meet the criteria of the first phase in order to include a wider range of companies.

Austria: In Austria, the use of electronic invoicing is already mandatory in the B2G sector. There is currently no obligation to issue electronic invoices for B2B transactions, but it is apparent that such a requirement could also be introduced here. To support this, a central platform (eRechnung.gv.at) has been established for the electronic invoicing process, which is also connected to the PEPPOL network.

Switzerland: Since 2016, companies in Switzerland have had to use electronic invoices when doing business with government agencies. This is not mandatory for B2B and B2C companies, but is nevertheless widespread. The government is promoting the use of electronic invoices, which is encouraging many companies to voluntarily digitize their invoicing processes.

Netherlands: Electronic invoicing has been mandatory in the B2G sector since 2017 in the Netherlands. Although there are no concrete plans yet to introduce the automated exchange of e-invoices in the B2B sector, the Netherlands is expected to make e-invoicing mandatory in the next few years, similar to Italy and Belgium. There could also be legislation to make using e-invoices for B2B transactions mandatory soon.

Italy: On 01.01.2019, the use of e-invoices became mandatory for all companies in Italy, regardless of whether the invoice was addressed to a public institution, a company based in Italy, or a private individual (B2G, B2B, and B2C). This regulation only applies to invoices within Italy. From July 2022, all transactions, including those with foreign partners, must be transmitted to the “Sistema di Interscambio” (SDI) invoice transmission system.

European Union: The EU has a joint directive that regulates the e-invoicing obligation. The directive was issued in order to create a uniform standard for electronic invoicing in public procurement. The directive’s main implementation is the XML format.

What Is The Best Way For Companies To Prepare?

Preparing for the e-invoice mandate requires companies to take a strategic approach and implement appropriate measures. A change in the law requires careful planning to ensure compliance. Especially for companies that still work with paper invoices and PDFs, the changeover poses a considerable challenge. What are the best steps to take to prepare for the e-invoicing obligation?

Early analysis of legal requirements

Companies should analyze the introduction dates and specific requirements for mandatory e-invoicing in the countries in which they operate at an early stage. This enables timely preparation and implementation of appropriate measures.

Formation of an implementation team

A specialized implementation team can deal specifically with the legal, technical, and procedural aspects of the e-invoice mandate. This allows responsibilities to be coordinated and ensures that all relevant departments are involved in the preparation process.

Standardize processes and systems

Adapting invoice processing processes to standardized formats such as ZUGFeRD or Factur-X is crucial for companies to meet the requirements of digitalization – and digitalization itself is the solution to these challenges. Introducing a suitable software solution plays a central role in effectively preparing companies for the e-invoicing obligation and ensuring a seamless transition to electronic invoices.

Particularly regarding requirements for signatures, archiving and compliance, it is recommended to consider the introducing of software for digital invoice processing at an early stage. This enables companies to find a suitable solution and adhere to the specified timeline.

However, the e-invoice mandate is not the only reason to digitize and automate the invoice processing process. In addition to complying with legal regulations, digital invoice processing offers numerous other benefits, including increased efficiency, a reduction in the error quota and cost savings for the company. In accounts payable in particular, the challenges of manual invoice processing can be overcome with precision using simple digital solutions.

One particular example of this is Medpets, a long-standing Onventis customer. By automating invoice processing, the online store was able to process invoices more than 65% faster. The software’s user-friendly interface enables the entire accounts payable team to implement the process digitally and strengthens collaboration at the same time. Both employee satisfaction and Medpets’ business success benefit from digital invoice processing in the long term.

E-Invoice Mandate: The Bottom Line on the Law

The increasing harmonization of the e-invoicing obligation in the European Union strongly underlines the need for companies to prepare and adapt their invoice processing procedures at an early stage. Precise knowledge of national regulations and deadlines is crucial to meet the legal requirements and ensure a smooth transition to mandatory e-invoicing.

The introduction of mandatory e-invoicing may seem like a challenge, but it also presents an opportunity for companies. Through the clever use of automated software solutions, companies can not only comply with legal requirements but also take advantage of the many benefits of e-invoicing. Automation offers the opportunity to establish more efficient, transparent, and cost-effective invoice processing procedures.

In this changing environment, it is essential for companies to not only respond to legal changes but also proactively develop strategies to integrate e-invoicing into their business processes in the most efficient way. A well-thought-out implementation can not only ensure compliance but also lead to a competitive advantage through improved efficiency and cost reduction.

Key sources of information

We have compiled an overview of information on the e-invoicing mandate to help you with the changeover.

Weitere BlogsMore BlogsMeer blogs