Navigating Automated Finance: A Catalyst for Role Enhancement, Not Replacement

The rapid advancement in technology, particularly in automation and e-invoicing, is reshaping the finance sector. These innovations offer myriad benefits, they also bring apprehensions, especially among finance professionals concerned about the future of their roles. While others, especially accounts payable professionals, already know that automation positively impacts job satisfaction.

Let’s demystify the impact of automated finance on jobs and highlight how finance professionals can navigate and thrive in this evolving landscape.

Navigating Automated Finance: A Catalyst for Role Enhancement, Not Replacement

The rapid advancement in technology, particularly in automation and e-invoicing, is reshaping the finance sector. These innovations offer myriad benefits, they also bring apprehensions, especially among finance professionals concerned about the future of their roles. While others, especially accounts payable professionals, already know that automation positively impacts job satisfaction.

Let’s demystify the impact of automated finance on jobs and highlight how finance professionals can navigate and thrive in this evolving landscape.

The Strategic Shift: Embracing Automated Finance

The finance sector’s journey toward automation and e-invoicing is more than an efficiency upgrade; it’s a strategic evolution. Groundbreaking technologies like Artificial Intelligence (AI), Machine Learning (ML), and Robotic Process Automation (RPA) are at the forefront of transforming finance from a primarily task-focused discipline to a strategic cornerstone within businesses.

Automation has already been proven to improve employee satisfaction, reduce the chance of burnout, and decrease employee turnover within AP teams. The Institute of Finance and Management reports that AP teams are processing a growing number of invoices every quarter. “Half [of surveyed AP teams] say they are working longer hours to make up for the additional work; the rest are adding staff or automation to help with the increase in demand.” Automation can help employees retain a work-life balance while handling the ever-increasing workload.

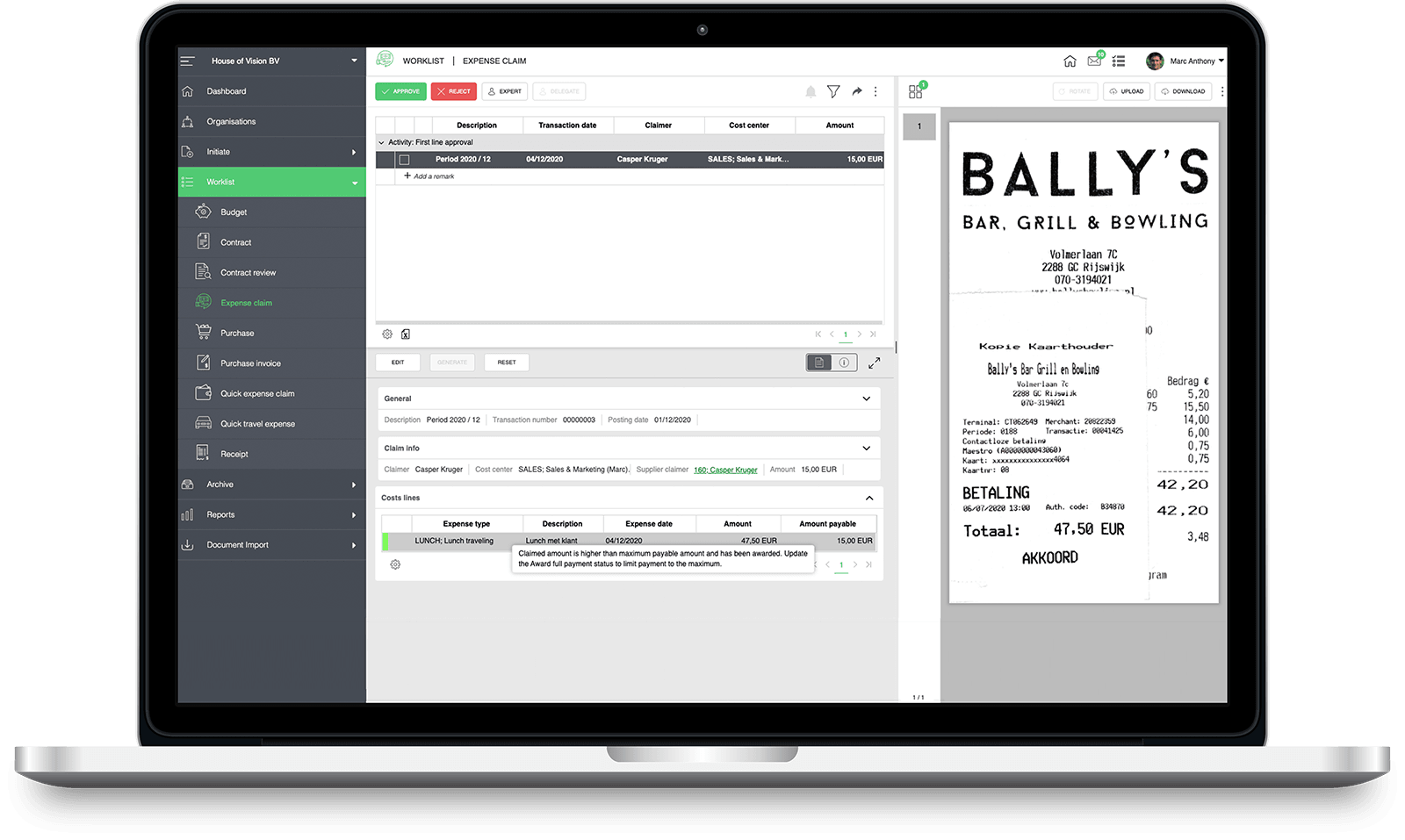

RPA plays a crucial role as a bridge to this new era by automating repetitive tasks such as data entry, reconciliations, and report generation. This not only curtails the margin for error but also expedites processes, leading to a remarkable increase in operational efficiency. Critically, it liberates finance professionals to engage with more nuanced and impactful projects, enhancing their contribution to business strategy and growth.

Furthermore, finance automation extends into compliance and risk management, areas where accuracy and diligence are paramount. Automated systems offer persistent monitoring and reporting tools that ensure regulatory compliance and risk minimization, encapsulating the holistic benefits of automation in finance.

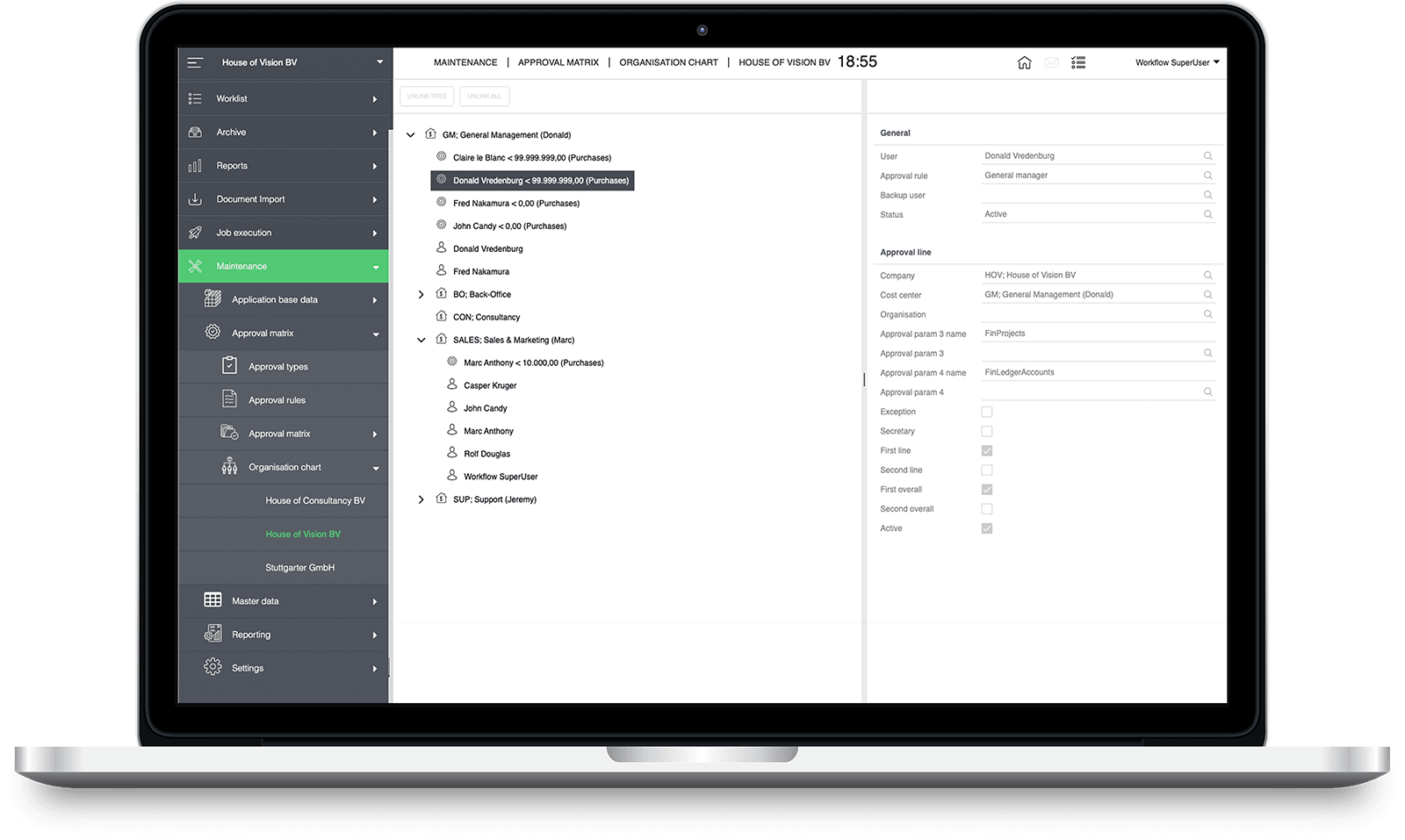

Embracing automation heralds a significant shift for finance departments, transforming them into pivotal strategic partners within their organizations. This evolution demands a collaborative approach, uniting finance professionals, IT experts, and business leaders to craft and deploy automated solutions that resonate with broader organizational objectives.

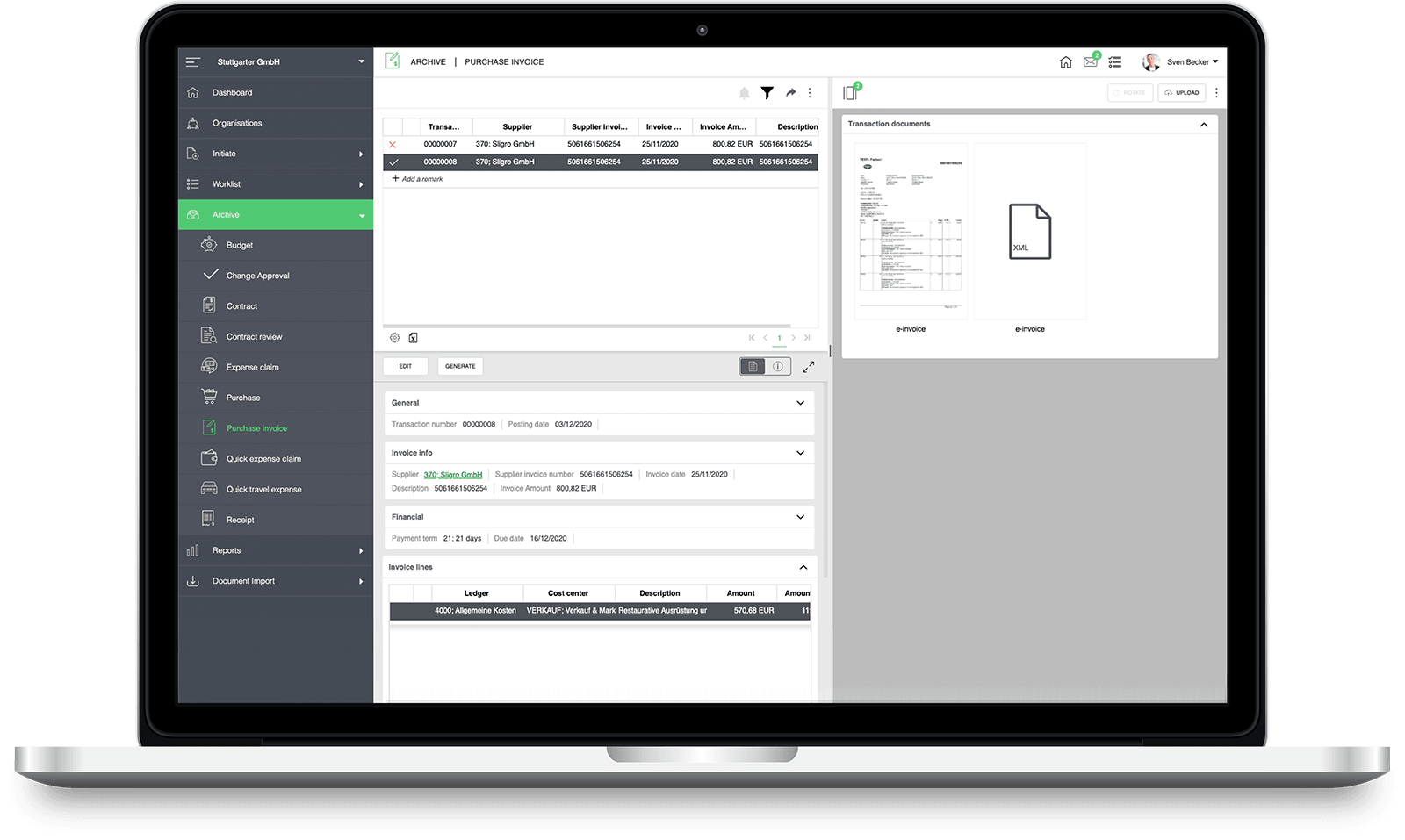

E-invoicing is rapidly becoming the norm for both outgoing and incoming invoices, driven by its efficiency and the ability to streamline the payment process. By encouraging buyers and suppliers to adopt e-invoicing, companies comply with e-invoicing regulations and pave the way for more standardized and seamless transactions. This digital shift is instrumental in ensuring timely payments, reducing errors in data capture, and meeting new requirements, such as booking to individual cost centers, which, although initially challenging, ultimately enhances reporting capabilities.

The regulatory environment for e-invoicing is evolving, with more stringent regulations expected to be introduced. Finance professionals are cognizant of the need to issue and process invoices in compliance with existing laws, underscoring the importance of adaptability and awareness of regulation.

E-Invoicing Mandate: What Companies Need to Know Now

- Requirements for the e-invoice

- Timeline of the e-invoicing mandate

- What is the best way for companies to prepare?

Embracing Change on the Path Forward

While the prospect of embracing automation may seem daunting, the benefits far outweigh the challenges. By adopting a proactive approach and investing in the right technologies, finance professionals can position themselves as strategic partners within their organizations, driving innovation and unlocking new avenues for growth.

As automation reshapes the finance landscape, it’s crucial for professionals to embrace a mindset of continuous learning and skill development. By staying abreast of emerging technologies, honing analytical abilities, and cultivating strategic thinking, finance professionals can future-proof their careers and thrive in an increasingly automated environment.

The journey towards automated finance requires collaboration across departments. Finance professionals must collaborate closely with IT specialists, data analysts, and business leaders to design and implement automated solutions that align with organizational goals and priorities. By fostering a culture of collaboration and knowledge sharing, finance departments can maximize the impact of automation initiatives and drive sustainable business growth.

At its core, automation is about driving innovation and efficiency. Finance professionals must embrace a culture of innovation where experimentation, creativity, and continuous improvement are celebrated. By challenging the status quo, embracing new ideas, and embracing a mindset of innovation, finance departments can unleash their full potential and chart a course toward long-term success.

While automation brings increased accuracy, lower operating costs, and productivity gains, integrating automation with existing legacy systems can be challenging for CFOs, according to research by SnapLogic. This suggests a recognition of automation’s importance in finance but acknowledges the hurdles in achieving seamless integration and full utilization of automation technologies. The transition will take time, which is all the more reason to get started sooner rather than later.

The Future of Finance

The transition to automated finance is not just a trend; it’s the future of the finance sector. As you look to navigate these changes, remember that you don’t have to do it alone. Our AP Automation and Spend Analytics software are designed to streamline your finance operations and unlock new levels of efficiency and insight. Ready to take the first step towards transforming your finance department? Contact us today to explore how our solutions can empower your team and drive your business forward. Let’s shape the future of finance together.

Weitere BlogsMore BlogsMeer blogs